The head of Carrington, which is known as an established distressed debt investor, a servicer that has been a target of litigation, and more recently, an early entrant in the single family home rental business, said this week it was no longer buying houses for lease because dumb money had ruined the market. From Bloomberg:

?We just don?t see the returns there that are adequate to incentivize us to continue to invest,? Rose, 55, chief executive officer of Carrington Holding Co. LLC, said in an interview at his Aliso Viejo, California office. ?There?s a lot of ? bluntly ? stupid money that jumped into the trade without any infrastructure, without any real capabilities and a kind of build-it-as-you-go mentality that we think is somewhat irresponsible.?

The degree to which the housing ?recovery? has been driven by speculators isn?t fully appreciated. Reuters tried to pin down a number, but they apparently did it by identifying specific private equity firms and tying them to purchases. They came up with ?at least 10%? in Las Vegas, suggesting that was representative for the most distressed markets.

But while it?s hard to get good data in such a fragmented field, that estimate is likely to be markedly too low. Some sources have said that cash buyers have accounted for as much as 50% of the activity in the hottest states, and those would also have a bigger impact in the national estimates of home price appreciation.

Why are these investors so hard to identify? Many are newbies. One colleague reports that he knows roughly 15 newly minted real estate mini-moguls. They might have had some cash from a previous life on Wall Street, and raised a bit more initial dough from well-heeled friends. But most after buying a few houses then raised money overseas, mainly from the Middle East and China. They may call themselves hedge funds as a way of glamorizing their strategy and justifying asking for hedgie-type fee structures, but it?s more accurate to simply call them investors.

A tally by lawyer and foreclosure fraud investigator Lynn Szymoniak illustrates how the players in her backyard, Palm Beach County, are mainly buyers you?ve never heard of, as opposed to the big PE firms, but upon further digging, a different picture emerges. Her comment via e-mail:

I?ve been researching who is buying up properties from Fannie, Freddie, HUD and the big trustee banks.

You can do this easily enough by searching Deeds filed in 2013, by county.

The systems will provide an alpha list of purchasers from any single seller.

Once you get the name of the purchasers, such as 2012-C Property Holdings, Badger Investments, or THR Florida, LP, then the trick is to find the parent. Many roads seem to lead to Minnetonka, MN.

I like reading the credentials of the management ? such as the top officers of Two Harbors Investment Company, a company favored by Deutsche Bank. Interesting to see that experience with a failed mortgage company is touted like a victory of some strange kind.

After you find the names of the most frequent buyers, you can search deeds by that name to see how many properties were acquired by that company by county in the past 18 months.

Two Harbors is buying many Deutsche Bank foreclosed homes through its subsidiary, THR Florida, LP, after Deutsche Bank loaned Two Harbors $600 million in October 2012.

Interesting, too, to compare the sales price to the value of the mortgage on the trust records.

None of this bodes well for any real housing recovery.

The banks are indeed selling a small portion of their stockpile, and these are some of the buyers

in Palm Beach County so far in 2013:Break Point Verde, LLC (3)

Cani Vida Corp. (2)

Dalipa, LLC

Danelia, LLC

Delle Alpi, Corp. (3)

Emerald White York, LLC

Expedits, LLC

Fast Holding I, LLC (2)

Grenoble G & F, LLC

Guamavel, LLC

Javelin Holdings, LLC (2)

Just Makers, LLC

Mafal Corp.

Mapag, LLC

Marsh Harbor Investments, LLC (3)

National Nine, LLC

Shiu, LLC

Sociedad Familiar, LLC

St. Andrews Venture, LLC (2)

Tinfloor

Viento Sur Corp.

View Holdings, LLC

AHE Enterprises, Inc.

AIC, LLC

Altun Real Estate LLC

America On Land, LLC

Beckmann, LLC (2)

Bentley Capital Partners, LLC

BMAN Enterprises, LLC

Cabrera Construction, Inc.

Carmenohio Properties, LLC

Clever House, LLC

Come Home, LLC

EDG 302, LLC

EH Pooled Investments, LP

El Torreon, LLC

First Heritage Holdings, LLC

Florida Rental Specialists, LLC

FTC Group, LLC

GHI Capital, LLC

Golden Arrow Management, LLC

Golden Goose Properties, Inc.

GQ Holdings 1329 LLC

Harvest Residential II, LLC

Honey Dew Cleaning, LLC

Juto Rentals 1, LLC

Kamis Properties, LLC

KG Investments Group, LLC

Letana Delray, LLC

M Y N Investments LLC

Maju Enterprises, LLC

Max Simon Properties, LLC

Palm Beach Financial Solutions, LLC (8)

Park Manor Capital Partners, LLC

Portico Properties, LLC

Pure Properties, LLC

RBD Lending Financial, Inc.

Rebound Residential, LLC

Reliable Housing Management, LLC

Seaward T & X, LLC

Spark Propetries, LLC

Stellar Alon, LLC

Strategic Investor Group, LLC

THR Florida LP (2)

Top Red Business LTD

Tundra Realty, LLC

Via Carbonara, LLC

Walnut Street Capital, LLC

WSC Trust LLC

Zakai, LLC

815 7th Street, LLC

To clarify matters, Minnetonka is the home of Pine River, a hedge fund that also owns a REIT, and I?m told the REIT is likely the buyer of the homes. But REITs are required to pay out most of their cash flow as dividends, which limits how much they can spend on maintaining properties. That means that if the REIT is indeed the buyer, Pine River is probably fixing up the homes before flipping them to the REIT. An awful lot less than arms-length pricing, needless to say.

An additional issue is that if Pine River is indeed buying homes all over Florida, as opposed, say, to concentrating in a few markets, that?s also contrary to what most PE investors consider to be a viable strategy. In the discussions I?ve attended, they stressed that there was a dead zone between four houses and about 200, that you can get economies of scale over that level. And if you are managing 200 or more, they need to be in clumped geographically, say a large grouping on the north side of Atlanta and another on one area of another MSA.

Now I?d anticipate, given the keen interest in Florida, that Szymoniak?s list includes some of the real estate mogul wannabes that my colleague discussed. Given all the press about rentals, most observers would assume that they were playing that game too. But my source with the 15 newbie investors said that was often not the case. He said even with other people?s money in the form of foreign investors, they were also leveraging, just not in the form of a mortgage. Berkshire Hathaway, for instance, is providing warehouse lines, marketing them to people who are over the friends and family level of investing but below $25 million. They are expected to repay in 18 to 24 months.

And what are these investors doing? According to my source, they often aren?t renting but are warehousing the properties, sometimes renovating them (I didn?t nail down whether to flip to a renter or to sell to a buyer) or simply holding them for expected appreciation.

So consider what this means. An unknown but in certain locations, meaningful proportion of homes sold are being warehoused yet again, and will be dribbled out later. This means we have not only servicers keeping homes off the market to keep from depressing prices, but certain investors also contributing to the the perception that inventories are tight by keeping homes unoccupied and off the market.

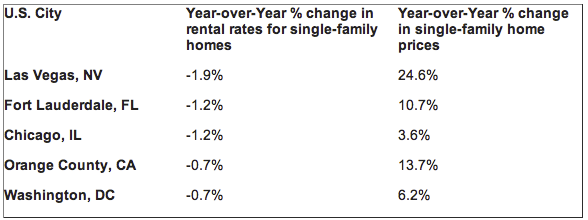

And this strategy is not looking like it will necessarily be a winner. The Bloomberg article reports, as we predicted, that the very act of putting more rental homes on the market has lowered rental rates. And rents are falling before PE investors are showing a profit. Now they may argue that they will, but at this point, it?s what the Japanese call ?seller talk?. The big PE rental empire builders have yet to reach ?stabilized yields? where they?ve got their portfolios leased up and can say based on experience what typical vacancy costs and maintenance costs are. From the story:

Even as demand for rentals rises amid a falling homeownership rate, yields are declining and companies formed to buy the homes that have gone public haven?t yet been profitable?

Funds are buying property now, including homes sold by Carrington, for rents that yield 6 percent to 8 percent a year, before costs such as insurance, taxes and vacancies, according to Rose. Carrington?s model called for mid-single digit net returns on annual rents on an unlevered basis, according to Rose. While returns would vary by market, they would generally be in the mid- to high teens over the duration of the holding period, with the profit from home price appreciation.

This chart from Michael Lombardi, via Testosterone Pit, shows how rent levels are softening:

Mind you, last October, I had institutional investors telling me PE funds who were pitching them were forecasting 5% per annum rental increases. That looked ridiculous to them given stagnant wage growth.

The Bloomberg account makes clear that one of the true believers is PE kahuna Blackstone:

Blackstone Group LP, the largest investor in single-family rentals, has spent $4.5 billion to amass more than 26,000 homes and continues to buy, according to Eric Elder, a spokesman for Invitation Homes, the rental housing division of the world?s largest private equity firm.

?We?re continuing to purchase homes where they fit into our business plan,? Elder said.

Blackstone?s net yields on its occupied houses are about 6 percent to 6.5 percent, Jonathan Gray, the firm?s global head of real estate, said during a May 3 conference call with investors. That?s before using leverage from a $2.1 billion line of credit the private-equity giant arranged in March from a lending syndicate headed by Deutsche Bank AG.

While about 85 percent of Blackstone?s renovated homes were leased, Gray said, ?we?ve got an awful lot of homes to continue renovating.?

Sounds like whistling in the dark to me. But Blackstone has a record of continuing to buy at the peak, famously evidenced in the last cycle by buying Equity Office Trust from Sam Zell in February 2007. And that?s not as irrational as it sounds. Blackstone will make money regardless of how its investors do, and it has such an established brand name that it is virtually immune to its own performance (remember how John Meriwether, former head of LTCM, has become a serial fund manager failure yet can still raise money).

Further complicating the picture of a profitable exit is the Fed?s talk of ending QE. Even if the central bank has overestimated the pace of ?recovery?, the mere talk of ending QE has put the mortgage market in a swoon. Fixed-rate mortgages reached their highest interest rate in a year last week and with the increase in Treasury yields this week, are almost certainly higher. This might complicate their plans to have homebuyers take them out. Even if banks loosen underwriting standard (which are tight right now), it won?t take all that much in the way of mortgage rate increases to reduce affordability (the PE funds are more likely to exit via selling the operating company that owns and manages the rentals in an IPO, but the experts thought you needed 1000 homes or so for that to be attractive, which is well beyond the scale of the small fry).

Many of these players have a had a great ride being long real estate in many forms over the last few year. How well the market fares when they choose to cash in their chips is very much an open question. I would not want to be on the other side of their trade.

bruno mars the Grammys 2013 State of the Union 2013 katy perry Rihanna Katy Perry Grammys 2013 Ed Sheeran

No comments:

Post a Comment