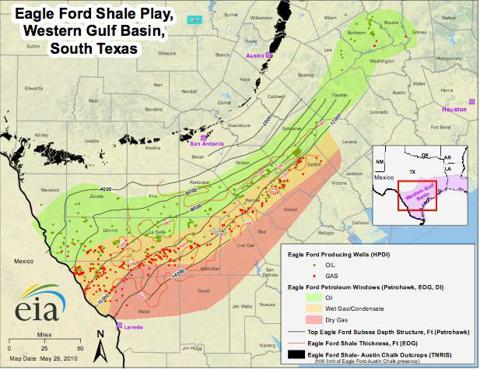

Energy companies are making a huge bet on South Texas. The Eagle Ford is now the largest single oil and gas development in the world based on capital expenditures. The Eagle Ford Shale is a geological formation spreading across some 20 counties from southern to central Texas. It is believed to be the "source rock" for all the hydrocarbons above it, including dry gas, wet gas, natural gas liquids, condensate and finally oil.

(click to enlarge)

The Eagle Ford has attracted companies big and small. It was originally discovered by PetroHawk in 2010. Big capital early movers include ConocoPhillips (COP), EOG (EOG), Chesapeake (CHK) and Anadarkro (APC). PetroHawk would later be bought by mega cap resource company BHP Billiton.

All of these above companies have their eggs in many different baskets. To get a pure play on the Eagle Ford we have to look for much smaller operators. Today I'm going to look at one of those companies, Sanchez Energy (SN).

A Unique Concentration

Sanchez Energy is an independent exploration and production company whose concentration is entirely in the Eagle Ford Shale. Its market cap sits at $845 million. While operations are entirely in the Eagle Ford, Sanchez does have some undeveloped land in the Woodbine of East Texas and the Montana portion of the Bakken.

Sanchez Energy is an independent exploration and production company whose concentration is entirely in the Eagle Ford Shale. Its market cap sits at $845 million. While operations are entirely in the Eagle Ford, Sanchez does have some undeveloped land in the Woodbine of East Texas and the Montana portion of the Bakken.

Texan readers may remember the 2002 Democratic Gubenatorial candidate Antonio "Tony" Sanchez and his bid to unseat Rick Perry. Well, he's now the CEO and founder of this company which bears his namesake.

Amazing Returns In The Core "Sweet Spot"

Management's goal is pretty straightforward: To build a portfolio of contiguous producing acreage that can benefit from economies of scale. Sanchez was fortunate enough to be an early, nimble mover and wisely concentrated on oily assets. As of today, 75% of its reserves are oil.

While Sanchez has four contiguous producing areas here, the most prolific by far is "Palmetto" in Gonzales County, the core of this shale play. Palmetto accounts for 62% of Sanchez's production. This is some of the best land in the Eagle Ford, surrounded by big players like Conoco and EOG. At $90 oil, it fetches an amazing 119% Internal Rate Of Return.

Growth Hits An Inflection Point

Production in Q1 grew by 320% over last year and revenue grew by 303%. Management's target for 2013 is triple-digit production growth once again.

Production in Q1 grew by 320% over last year and revenue grew by 303%. Management's target for 2013 is triple-digit production growth once again.

Yes, this growth is very impressive given some of the well economics, but this year Sanchez hit its growth inflection point. Going forward, Sanchez will be more about development and less about acquisitions and explosive growth. There will likely be continued growth in 2015 and beyond, but it will not match the acquisition and exploration-fueled growth of last year's.

Profitability

As with most oil companies at this stage of its life, Sanchez has yet to post a profit. Don't expect this trend to reverse too soon, either. The development stage will also require a lot of capital. But there is light at the end of this tunnel.

First, Sanchez is steadily lowering well costs. The cost per well is at a very high $10 million but new wells this year should cost only $9.5 million on average. While these wells are more expensive than Conoco's or even a peer such as Carrizo (CRZO), the costs are coming down. This is being driven by multiple well pads and a shared infrastructure.

Second is Sanchez's funding gap. A funding gap is when an energy company's Capital Expenditure (for growth) exceeds Operating Cash Flow. While the funding gap seems large and growing out of control, remember that the company was in acquisition mode until only recently. Now that Sanchez has hit its inflection point, we can expect the funding gap to start closing. All other things being constant, management expects Sanchez to be capital neutral by 2015 on profitable development and efficiency efforts.

Second is Sanchez's funding gap. A funding gap is when an energy company's Capital Expenditure (for growth) exceeds Operating Cash Flow. While the funding gap seems large and growing out of control, remember that the company was in acquisition mode until only recently. Now that Sanchez has hit its inflection point, we can expect the funding gap to start closing. All other things being constant, management expects Sanchez to be capital neutral by 2015 on profitable development and efficiency efforts.

But the key phrase is "all other things being constant." There's a good chance Sanchez will find some other Eagle Ford opportunities in these next couple years.

Debt

Amazingly, Sanchez has grown with little or no debt up until very recently. We shouldn't expect this trend to continue much longer for a couple of reasons, however. As Sanchez moves into its development stage and out of exploration, it will become more efficient and less risky, improving its standing in the eyes of creditors. This will reduce its cost of borrowing and make debt a more attractive option.

Secondly, they themselves have said as much.

In connection with the acquisition we have secured commitments for $325 million in debt financing

and expect to access the capital markets in the near term, subject to market conditions and other factors.

Sanchez Energy 2012 Annual Report

This financing likely has to do with a recent acreage acquisition from Hess just a ways up the road from Laredo, which I will cover in a moment. But regarding debt, Sanchez will be looking more conventional soon. Perhaps, the most important takeaway here is that Sanchez has the capacity to develop and acquire in the Eagle Ford.

Acquisition

In May of this year Sanchez completed an acquisition of 43,000 net acres outside of Coatulla, between Laredo and San Antonio, from Hess. This acquisition has added 13.4 million Barrels Of Oil Equivalent to Sanchez's reserves, 70% of which is oil.

Hess sold from a position of weakness, having to streamline operations under shareholder pressure. Paying $265 million to add 4,500 barrels of production per day, Sanchez paid a fair price. At $90 oil, we are looking at a breakeven period of 900 days from just the acquisition price.

Skepticism is not unwarranted here, but if you believe the Eagle Ford to be a decades-long play, then this acquisition will be a good one. Hess lacked the means to focus in South Texas and probably wanted to concentrate more on the Bakken. Sanchez will be able to develop the Coatulla assets just fine.

Valuation

Sanchez is difficult to value for two reasons. First, there aren't yet any profits, so P/E ratios are not useful here. Instead we will look at Price / Book ratios. Another difficulty is that Sanchez has so few peers. Comparing it to larger companies in the Eagle Ford would not really be appropriate. We need smaller, Eagle Ford centered companies. The closest two are Rosetta Resources (ROSE) and Carrizo: Both of them are primarily in the Eagle Ford, although Carrizo has assets in several places. And compared to these names, Sanchez is cheap.

Sanchez is difficult to value for two reasons. First, there aren't yet any profits, so P/E ratios are not useful here. Instead we will look at Price / Book ratios. Another difficulty is that Sanchez has so few peers. Comparing it to larger companies in the Eagle Ford would not really be appropriate. We need smaller, Eagle Ford centered companies. The closest two are Rosetta Resources (ROSE) and Carrizo: Both of them are primarily in the Eagle Ford, although Carrizo has assets in several places. And compared to these names, Sanchez is cheap.

At 1.3 times book value, Sanchez looks quite a bit cheaper than Rosetta and Carrizo. It's not quite clear why it may be at such a discount. Sanchez is much more conservatively leveraged than either of these. Sanchez's Palmetto assets outperform anything either one has. Maybe the market doesn't like Sanchez's well cost, which is considerably higher than either one. Or maybe the market is just overlooking Sanchez.

So what's the downside? At just one times book, the stock would be down by about 23% from here. If the Eagle Ford develops as many think it will, however, Sanchez could become a multi-billion dollar company. The current market cap is $867 million.

Conclusion

Sanchez is only an $867 million company, but I believe it can be a multi-billion dollar one as the Eagle Ford develops over time. Its sole focus on this formation provides something unique and simple for investors to participate in. It's pretty simple: If you like the Eagle Ford, you'll like Sanchez Energy.

Additional Sources:

"Funding Gap" and "Price / Book" charts by author, data by Morningstar.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: http://seekingalpha.com/article/1587472-the-eagle-ford-pure-play?source=feed

earthquake UFC 160 criminal minds London attack Doodle 4 Google Sergio Garcia kellie pickler

No comments:

Post a Comment